Problem 4-5 analyzing transactions into debit and credit parts – Problem 4-5: Analyzing transactions into debit and credit parts is a fundamental concept in accounting that provides a systematic approach to recording and understanding financial transactions. This guide delves into the intricacies of debit and credit entries, empowering you with the knowledge to effectively analyze and interpret financial data.

Understanding the dual-entry accounting system, T-account structure, and account types is essential for accurately recording transactions. By applying the rules for debit and credit entries, you can ensure the integrity and accuracy of your financial records.

Understanding the Basics of Debit and Credit Transactions

In the realm of accounting, the concepts of debit and credit transactions play a fundamental role in recording and analyzing financial information. Understanding these transactions is crucial for maintaining accurate financial records and ensuring the integrity of financial reporting.

Debit transactions represent an increase in assets or expenses and a decrease in liabilities, equity, or revenue. Conversely, credit transactions represent an increase in liabilities, equity, or revenue and a decrease in assets or expenses.

The dual-entry accounting system is a fundamental principle that governs the recording of debit and credit transactions. This system requires that every transaction be recorded with equal debits and credits, maintaining the balance of the accounting equation (Assets = Liabilities + Equity).

To visualize the impact of transactions, T-accounts are used. These accounts have two sides, one for debits and one for credits, and are used to track changes in account balances as transactions occur.

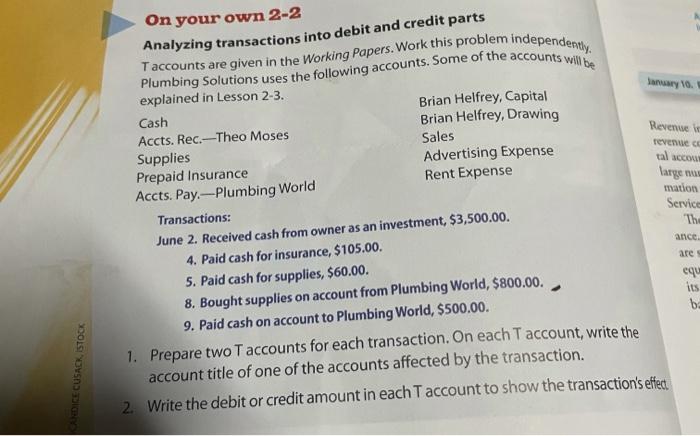

Analyzing Transactions into Debit and Credit Parts

To analyze transactions effectively, it is essential to identify the different types of accounts involved. These accounts fall into five main categories:

- Assets: Resources owned by the business, such as cash, inventory, and equipment.

- Liabilities: Obligations owed by the business, such as accounts payable and loans.

- Equity: The owner’s claim on the business’s assets, including capital and retained earnings.

- Revenue: Income earned by the business from its operations.

- Expenses: Costs incurred by the business in generating revenue.

The rules for recording debit and credit entries for each account type are as follows:

- Assets: Debit to increase, credit to decrease.

- Liabilities: Credit to increase, debit to decrease.

- Equity: Credit to increase, debit to decrease.

- Revenue: Credit to increase, no debit.

- Expenses: Debit to increase, no credit.

Using a Table to Organize Debit and Credit Entries, Problem 4-5 analyzing transactions into debit and credit parts

A tabular format can be used to organize debit and credit entries for easy analysis and visualization. The table should have four columns:

- Account: The account affected by the transaction.

- Debit: The amount debited to the account.

- Credit: The amount credited to the account.

- Description: A brief description of the transaction.

By recording transactions in a table, the impact on each account can be clearly seen, and the accuracy of the entries can be easily verified.

Clarifying Questions: Problem 4-5 Analyzing Transactions Into Debit And Credit Parts

What is the purpose of debit and credit analysis?

Debit and credit analysis helps to ensure the accuracy and integrity of financial records, identify errors, and provide insights into the financial performance of a business.

How do I identify errors in debit and credit entries?

Common errors include incorrect account selection, transposition errors, and omission errors. By carefully reviewing transactions and comparing debits to credits, you can identify and correct these errors.

How can I use debit and credit analysis to make better decisions?

Debit and credit analysis provides valuable information about the financial health of a business. By analyzing trends and patterns in financial data, you can identify areas for improvement, optimize resource allocation, and make informed decisions that drive business success.