Raising taxes and increasing welfare payments ________. – Raising taxes and increasing welfare payments is a complex and multifaceted policy issue that has been the subject of intense debate and analysis. This comprehensive exploration delves into the potential economic, distributional, and sociopolitical implications of such policies, providing a nuanced understanding of their intricate effects.

From the potential impact on GDP and inflation to the distributional consequences on income inequality and wealth distribution, this analysis examines the historical precedents and empirical evidence surrounding these policies. It also explores the political and social ramifications, including the potential for unintended consequences such as increased poverty or reduced social mobility.

Economic Impact: Raising Taxes And Increasing Welfare Payments ________.

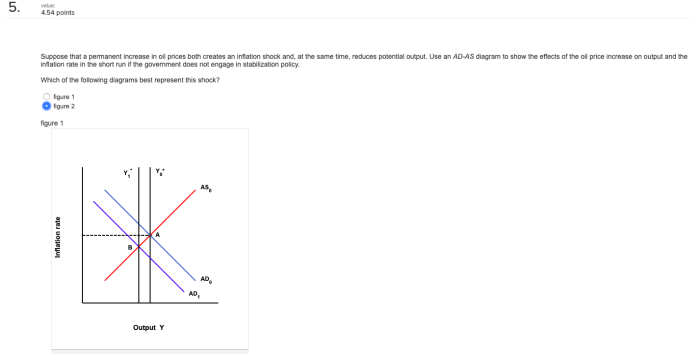

Raising taxes and increasing welfare payments can have significant economic consequences. The potential effects on GDP and inflation are complex and depend on various factors such as the size and composition of the tax increases and welfare payments, as well as the overall economic conditions.

Impact on GDP

In some cases, raising taxes and increasing welfare payments can lead to economic growth. This is because the increased government spending can stimulate demand and investment. However, if the tax increases are too large, they can reduce disposable income and lead to a decline in economic activity.

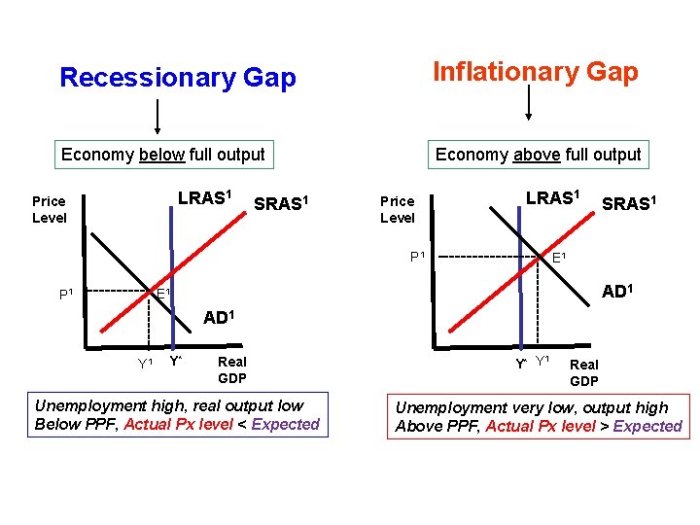

Impact on Inflation

Raising taxes and increasing welfare payments can also lead to inflation. This is because the increased government spending can put upward pressure on prices. However, if the tax increases are accompanied by measures to reduce government borrowing, the inflationary effects may be offset.

Historical Examples, Raising taxes and increasing welfare payments ________.

- In the United States, the New Deal policies of the 1930s, which included tax increases and welfare payments, helped to lift the country out of the Great Depression.

- In the United Kingdom, the austerity measures implemented after the 2008 financial crisis, which included tax increases and cuts to welfare payments, led to a decline in economic growth.

Impact on Specific Industries and Sectors

The impact of raising taxes and increasing welfare payments on specific industries and sectors can vary. For example, industries that rely on government spending may benefit from increased welfare payments, while industries that are heavily taxed may suffer from reduced profits.

Answers to Common Questions

What are the potential economic impacts of raising taxes and increasing welfare payments?

The economic impact of these policies is multifaceted, potentially affecting GDP, inflation, and specific industries. Historical cases provide insights into both positive and negative outcomes.

How do these policies affect income inequality and wealth distribution?

Raising taxes and increasing welfare payments can have significant distributional consequences. Data analysis reveals how different income groups are impacted, highlighting the potential for both intended and unintended effects.

What are the potential political and social implications of these policies?

These policies can have far-reaching political and social consequences. They may influence voter behavior, contribute to populism, and impact social cohesion and trust in government. Examples from different political contexts illustrate the complexities of these effects.